Setting Startup Market Valuations Effectively

Introduction

Understanding market valuations for high growth technology companies can feel like deciphering a complex code, but having an understanding of market norms is crucial for any company aiming to secure funding. Market valuations play a crucial role in determining how much your company is worth in the eyes of potential investors, while managing for long term dilution. In this guide, we'll walk you through the essentials of understanding and utilizing market valuations to your advantage.

How to Determine Private Market Value

First of all, what is market value? Market value refers to the estimated amount for which a company can be sold on the open market. It reflects the value that investors are willing to pay based on perceived potential, financial performance, and market conditions.

Determining private market value isn't just about picking a method and sticking to it. Often, a combination of methods provides a more accurate picture:

- Gather Financial Data

- An up to date financial projection model will allow you to estimate your cash needs for the next 18-24 months. Allowing you to model out how you would deploy new investment and grow revenue as a result.

- Analyze Market Conditions

- Understand the current market trends, investor sentiment, and economic factors that might affect your valuation. At the later stages companies are valued on a multiple of forward looking ARR. At the earlier stages, setting company valuations are based much more on market comparable for that stage, sector, and geography.

- Manage for Dilution

- Companies need to manage their dilution when fundraising, in order to preserve enough equity for future rounds of funding. The rule of thumb is to try to only sell around 20% of equity per round. This broken cap table chart from Backing Minds does a great job modeling that out and it well worth a look:

Later Stage Company Valuations

While there are various ways to calculate market value, here's a basic formula used in the Comparable Company Analysis:

Market Value = Share Price × Total Outstanding Shares

For private companies, adjustments might be needed to factor in control premiums or liquidity discounts.

- Bessemer Cloud Index:

- The Bessemer Cloud Index tracks the Forward Revenue Multiple for later stage companies. Putting aside the boom cycle of 2021, on average the Forward Revenue Multiple sits around 6x.

Priced Equity Company Valuations

When analyzing market valuations for priced equity rounds, one of my favorite people to follow is Peter Walker. He is the Head of Insights at Carta and is constantly publishing helpful information for founders. Here are he market valuations for Seed, Series A, Series B, and Series C fo the 25th, 50th, and 75th percentiles throughout Q1 2024.

Early Stage SAFE & Convertible Company Valuations

Peter and the Carta team also published some great Q1 2024 data on early convertible rounds run on SAFE's and Convertible notes.

Picking A Valuation For Your Company

Picking a valuation for your company is a balancing act between getting 3 things right:

Two inputs:

- Cash Needs:

- Raising an amount that is enough to execute and hit the milestones you need to hit in 24 months.

- Valuation:

- Setting a valuations that fairly values your business, while...

And one output:

- Dilution:

- ...managing dilution of the company stock so you don't have a broken cap table.

Negotiating Company Valuation With Investors

Investors look at deals all day. It's their full time job. So investors are usually very aware of where the market norms are for valuations at each stage of funding. And they are incentivized to pay a low a price as possible for a company, in order to increase their return multiple. It is also important to remember that the investor is often the "market maker" setting the valuation, as they are the one writing the check.

But founders only have one company and don't spend all day in the weeds looking at various rounds. And founders are often a "market taker" at earlier stages of funding.

This is why familiarizing yourself with anonymized market data can be a powerful way of level the playing field for founders. Having awareness around what are the market norms for valuations in your stage, sector, and geography can help protect founders from being taken advantage of.

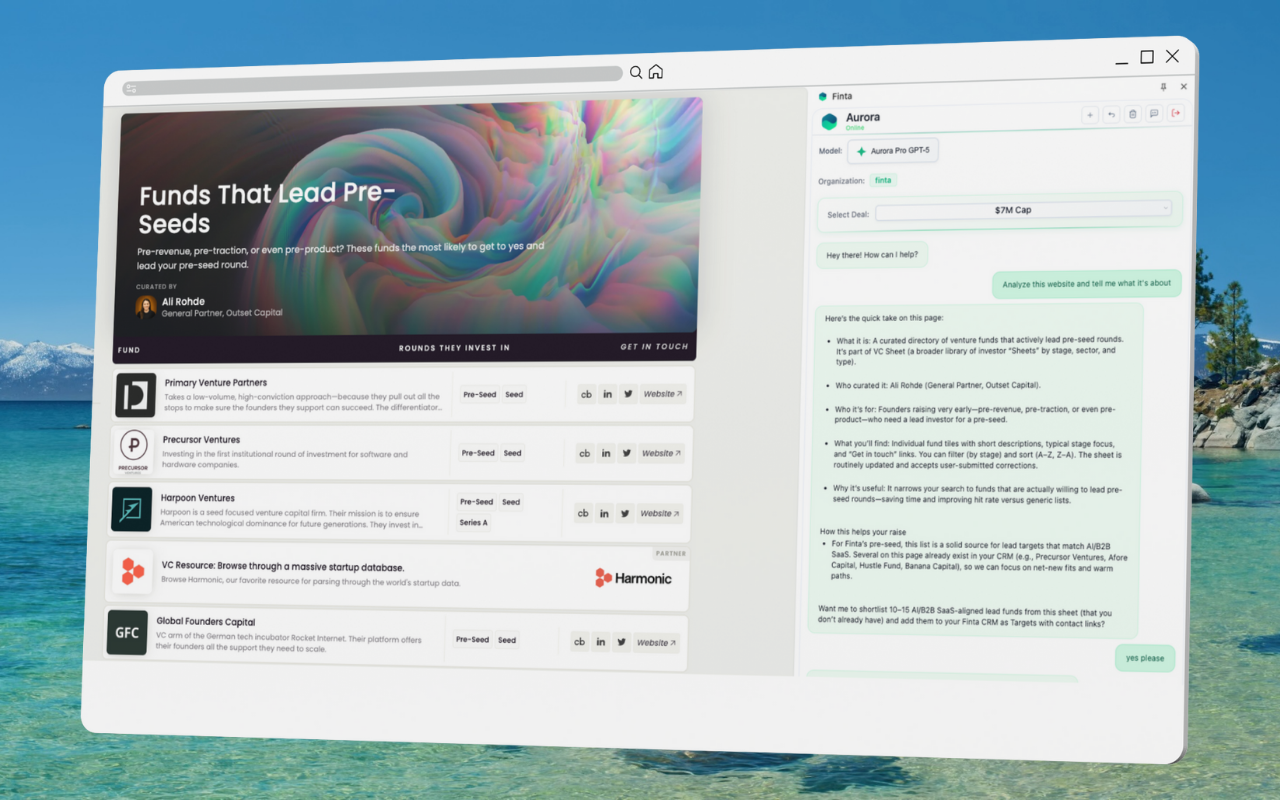

Leveraging Market Valuations with Finta

During Finta Academy we do a deep dive into all things valuation and look at market comps from several different places to help you land on the right fair market price for your company.

Finta’s platform also offers a comprehensive suite of tools to help you navigate the fundraising landscape:

- Investor-Focused CRM:

- Manage interactions with venture capital investors efficiently, keeping all communication streamlined and organized.

- Deal Rooms and Private Links:

- Share critical deal information and documents securely, ensuring potential investors have all the necessary data at their fingertips.

- Investor Database:

- Leverage Finta's extensive investor database to identify and target the most suitable investors for your fundraising efforts

Final Thoughts

Understanding and leveraging market valuations is both art and science. While confusing at first, get familiar with market norms can significantly impact your fundraising success. By utilizing the right methods and tools, like those offered by Finta, you can navigate this complex process with confidence and precision. Remember, a well-calculated market value not only attracts the right investors, but also sets the stage for sustainable growth and success of your company.

For more insights and tools to aid your fundraising journey, explore what Finta has to offer and transform your approach to market valuations!