Fundraising With AI

On Tuesday, June 3, Nelson Mullins NYC hosted an energized gathering of founders, investors, and tech enthusiasts eager to dissect modern fundraising strategies through the lens of AI. Set against panoramic city views, with the liquid death flowing, the evening captured quintessential NYC energy.

Featured Speakers

Kathryn Thiele – Founder & CEO, Buildstock

Kathryn brings 15 years of expertise building skyscrapers and is revolutionizing the $1 trillion construction supply chain through Buildstock—a B2B marketplace enhanced by fintech and AI-driven procurement processes.

Chuck Storman – Managing Partner, StartFast Ventures

An eight-time founder whose exits span natural-language processors, neural-network hardware, and telecom analytics platforms later acquired by Cypress Semiconductor, Osmose, and Oracle. A former chip-level AI researcher mentored by J. Alan Robinson, he now backs deep-tech founders investing $500K–$2M checks into promising B2B SaaS while exploring the frontier of autonomous agents, super alignment, and consciousness.

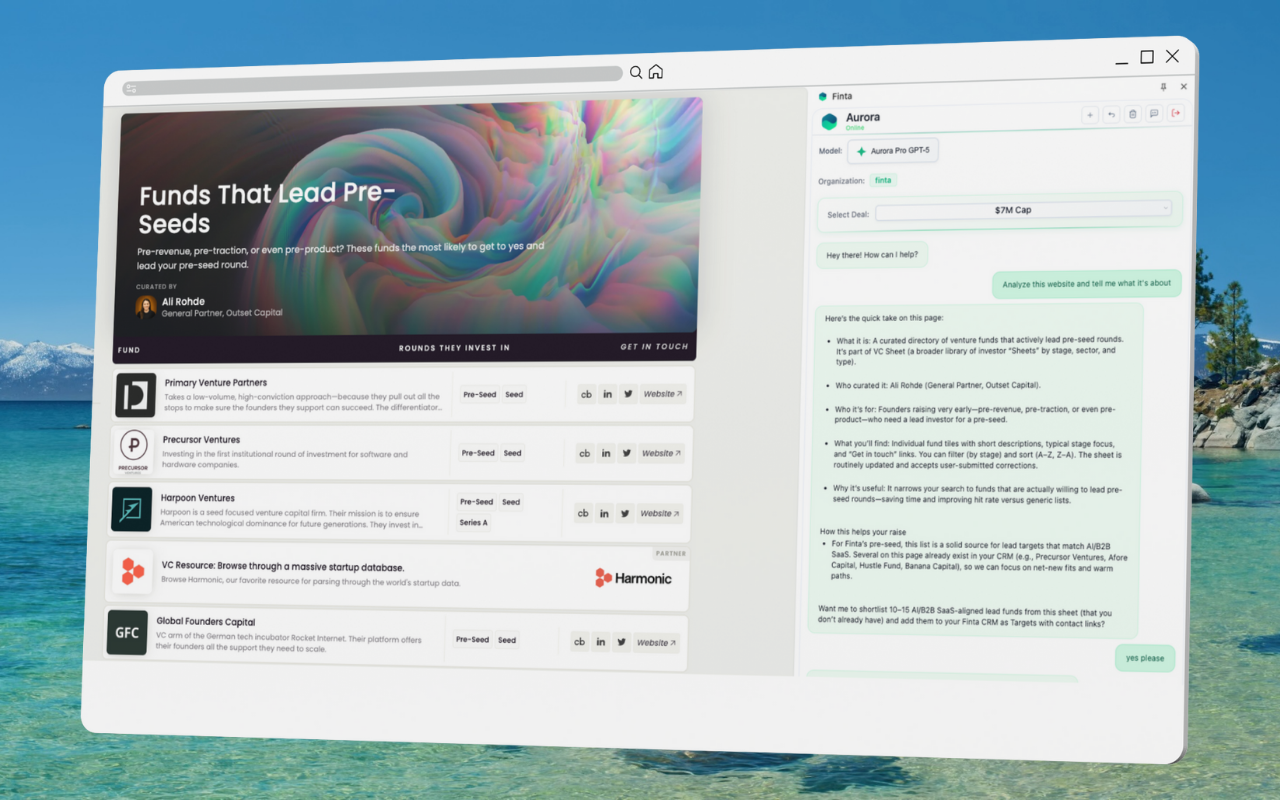

Kevin Siskar – CEO, Finta

Kevin leads Finta, the Cursor for Capital, that's automating over $500M in investor interactions. He is driving innovation through Finta's Aurora AI, designed to triple fundraising speed for founders.

Take A Listen To The Event:

10 Essential Takeaways

1. Relationships Fuel the Flow

Warm introductions account for 92% of fundraising success. Utilize your inbox and networks to find second-degree connections and send personalized, genuine outreach. The best results come from authentic relationship-building rather than impersonal mass emails.

2. AI as a Teammate, Not a Tool

AI agents have evolved from basic automation tools to essential team members. They now manage investor prospecting, personalize email outreach, and maintain data room integrity. This frees founders to focus on critical storytelling and strategic relationships.

3. Master the Triple-Triple-Double-Double

Seed-stage founders must clearly articulate a path to 10x revenue growth within two years. Investors prioritize startups that can significantly boost fund performance and deliver returns consistent with VC expectations.

4. Caution: Avoid Over-Raising

Securing excessively large funding rounds early might feel impressive, but it creates heightened expectations and intense pressure for unsustainable growth. Carefully align your fundraising amount with achievable milestones to ensure sustainable success.

5. Build Density for Momentum

Kathryn shared her highly effective strategy for fundraising: densely scheduling up to 10 investor meetings per day, strategically timed during the holiday season to create urgency. She spent extensive time beforehand warming relationships, allowing her to close a round swiftly in just three weeks.

6. Distinctive Data Matters

Chuck emphasized evaluating AI startups through three lenses: unique datasets, distinctive computational infrastructure, or novel algorithms. Investors aren’t impressed by generic AI claims; real differentiation in these core areas makes the difference.

7. Ask Investors, “What Keeps You Up?”

Addressing investors' specific concerns directly in follow-up communications helps convert hesitant prospects into active supporters. Explicitly outlining how you will mitigate their concerns shows thoughtfulness and commitment.

8. Making Fundraising Fun

Chuck Storman provided a valuable mental shift: view fundraising as an opportunity to engage deeply with intelligent, interesting people about your passion. Shifting the focus from outcome-driven pressure to genuine interactions helps maintain positivity and mental resilience.

9. Prioritize Strategically, Save Whales for Last

Kathryn advises against pitching the biggest investors first. Be strategic: rank and prioritize investors, refining your pitch with earlier conversations, and approach major "whale" investors when your story and momentum are strongest.

10. Understanding the Venture Capital Super Cycle

We might be experiencing a "once-in-a-millennium" venture capital cycle, marked by constrained LP investment and heightened caution. Despite these challenging conditions, as Warren Buffett advises, it's often beneficial to invest when others are fearful, setting up opportunities for bold founders.

(Explore more about the current venture capital super cycle here.)

Bonus Insight: The Human Edge

AI excels at many tasks but cannot replace authentic relationship building. The critical skills of intuitive "vibe checking" and genuine commitment remain indispensable, ensuring investor and founder relationships thrive.

Special Thanks

We extend heartfelt gratitude to Nelson Mullins for hosting, StartFast Ventures for their invaluable insights, and every dedicated founder who joined us amidst the vibrant chaos of NY Tech Week.