Series A Fundraising: A Comprehensive Guide

How Does Series A Funding Work?

Series A funding is a pivotal round of institutional investment that helps startups start to scale. Unlike seed funding, which is used to validate the product and market, Series A is about accelerating growth, hiring key talent, expanding the product, and go-to-market strategies. Startups typically raise between $5M and $15M from venture capital firms in exchange for 15–30% equity. The process involves pitching to investors, securing a lead investor, negotiating a term sheet, completing due diligence, and finalizing legal agreements. Once closed, the capital is deployed to hit key milestones that position the company for Series B.

Startup Fundraising: Understanding the Various Rounds of Funding

As startups grow and evolve, they usually raise capital in multiple stages. While the specifics can vary by industry and region, most startups follow a similar path through key fundraising rounds. Here’s a breakdown of the most common rounds:

- Friends & Family Round: < $250k, provides initial capital to launch the business, can include angel investors, family, and friends.

- Pre-Seed Round: < $2.5M, used to develop a proof of concept, conduct market research, and build a team before seeking seed funding. Target investors are mostly Friends/Family, Micro VC's, Angels, Incubator/Accelerator. Investment is used to prove technology.

- Seed Round: <$5M, used to acquire customers, further develop a minimum viable product, and validate the business model. Target investors are mostly Micro VC's, Angels, Institutional VC's. Investment is used to prove the market.

- Series A: <$20M, used to scale the business, expand operations, and hire additional staff. Target investors are mostly VC's, Super Angels, Family Offices. Investment is used to prove scale.

- Series B: <$40M, Used to help the startup further grow its operations, develop new products, and hire additional staff. Target investors are mostly Institutional VC's & Family Offices. Investment is used to prove profitability.

- Series C and up: <$80M, Funding provided to expand into new markets or make acquisitions, used to help the startup further grow its operations and increase its valuation. Target investors are mostly VC's, Crossover Funds, Growth Equity, Family Office. Investment is used to prove exit opportunities.

- Exit Event: An IPO or acquisition that provides liquidity to the startup’s shareholders and can be the final round of funding.

By understanding the different stages of fundraising, and knowing who to approach at each point, founders can navigate the process more strategically and raise the capital they need to grow and scale. It also helps determine when pre-seed funding might be the right fit for their business.

How Much Should You Raise for Series A?

The amount you should raise for a Series A round depends on your company’s goals, burn rate, and the milestones you need to hit before your next round—typically Series B. Most startups raise between $5 million to $20 million during Series A, with the median hovering around $10 million in the U.S. market. In other regions like Europe or Southeast Asia, Series A rounds may be smaller, often falling between $2 million and $10 million.

Rather than focusing on a specific number, think about how much capital you need to reach your next major milestone within an 18- to 24-month timeframe. Series A is typically about scaling product-market fit, so the funds should go toward building out your team, acquiring customers, improving key metrics like retention or CAC-to-LTV ratio, and laying the groundwork for a repeatable go-to-market strategy. For example, if you expect to burn $400K per month and want 18 months of runway, you’ll need to raise about $7.2 million, plus a buffer, bringing your target closer to $8 or $9 million.

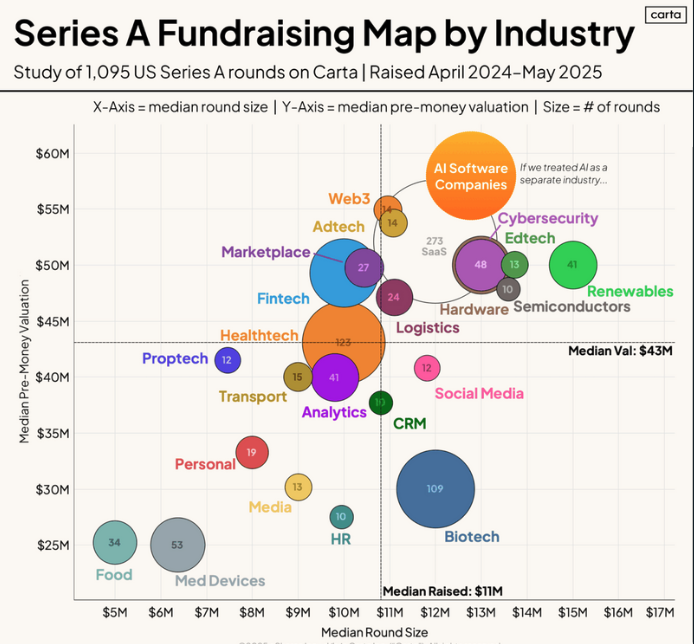

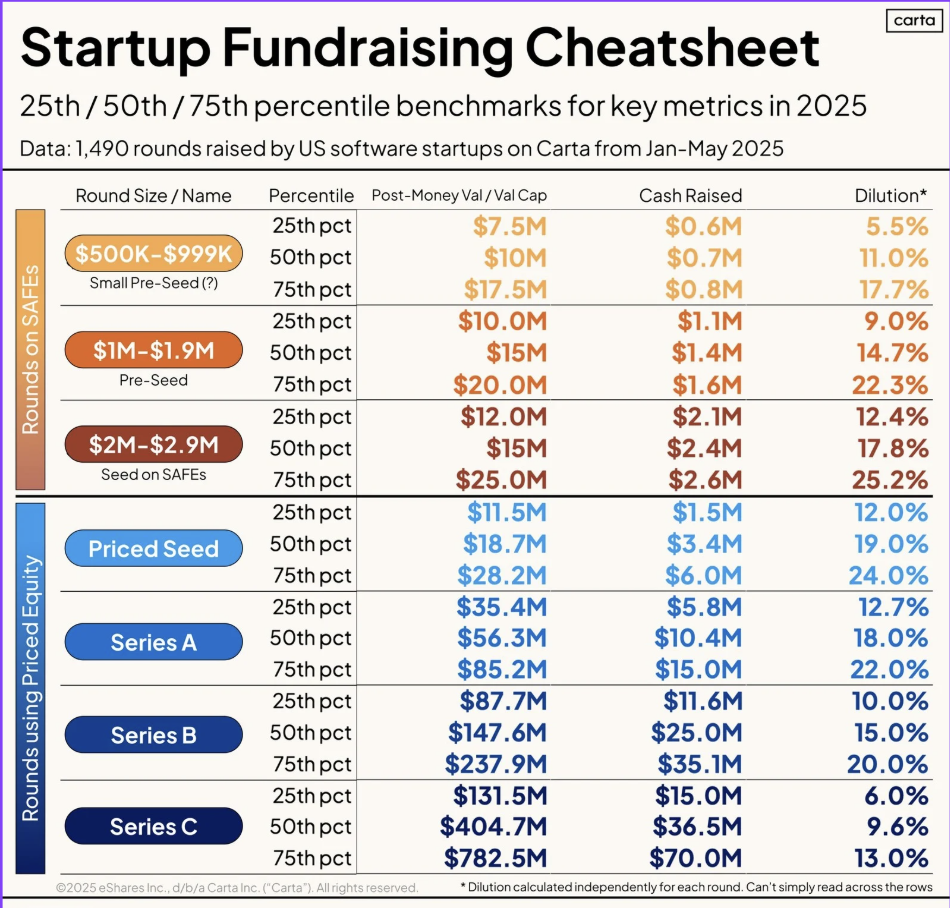

You should also consider valuation and dilution when determining how much to raise. Most founders aim to give up around 15% to 25% equity in a Series A. Make sure your target raise aligns with a reasonable valuation (typically $30 million to $80 million post-money) and doesn’t over-dilute your ownership too early. Ultimately, your Series A should provide enough capital to hit key growth metrics and build investor confidence for the next round, without raising excessive funds you don’t need. Peter Walker at Carta has shared some helpful insights on round amounts by sector:

How Do I Get Series A Funding?

To get Series A funding, you need to demonstrate strong product-market fit, early traction, and a clear path to scale. Most companies at this stage have a working product, real users or revenue, and growth metrics that show market demand. Series A companies on average are doing around $3m in annual revenue.

Start by preparing a compelling pitch deck and organizing your data room with financials, KPIs, and legal documents. Then, target venture capital firms that invest in your industry and stage, using warm introductions or strategic outreach to build investor interest. Throughout the process, clearly articulate how the funding will help you reach your next milestone, typically over 18 to 24 months, and look for investors who bring strategic value beyond just capital. Series A Rounds are when more institutionalized investors start to take larger positions on your cap table, so also be on the lookout for terms like liquidation preferences (a guaranteed multiple return to your investors) that could undermine returns to your common stock holders.

How Much Equity Should I Give Up in Series A?

In a typical Series A round, founders usually give up between 15% and 30% of their company’s equity. With the median at Series A being 18%. The exact amount depends on your company’s valuation and how much capital you need to raise to hit your next big milestones. Investors want enough ownership to justify their risk and involvement, but you also want to retain enough equity to stay motivated and attract future investors. If your pre-money valuation is higher, you’ll give up less equity for the same amount of money, which is ideal, but that requires strong traction and clear growth potential. On the flip side, if your valuation is lower, you might have to give up a larger stake to secure the capital you need. The key is to strike a balance: raise enough to fuel growth without diluting your ownership excessively.

What is the Average Series A Size?

The average Series A funding round typically ranges from $10 million to $15 million in the United States, though it can vary based on industry, geography, and market conditions. In major startup hubs like Silicon Valley or New York, rounds on the higher end—or even $20 million or more—are becoming increasingly common, especially for SaaS, biotech, or AI companies. In contrast, startups in emerging markets or less capital-intensive industries may raise smaller rounds, often between $2 million and $8 million. Ultimately, the size of a Series A round is influenced by the company’s traction, revenue growth, burn rate, and the milestones it needs to reach before raising a Series B.

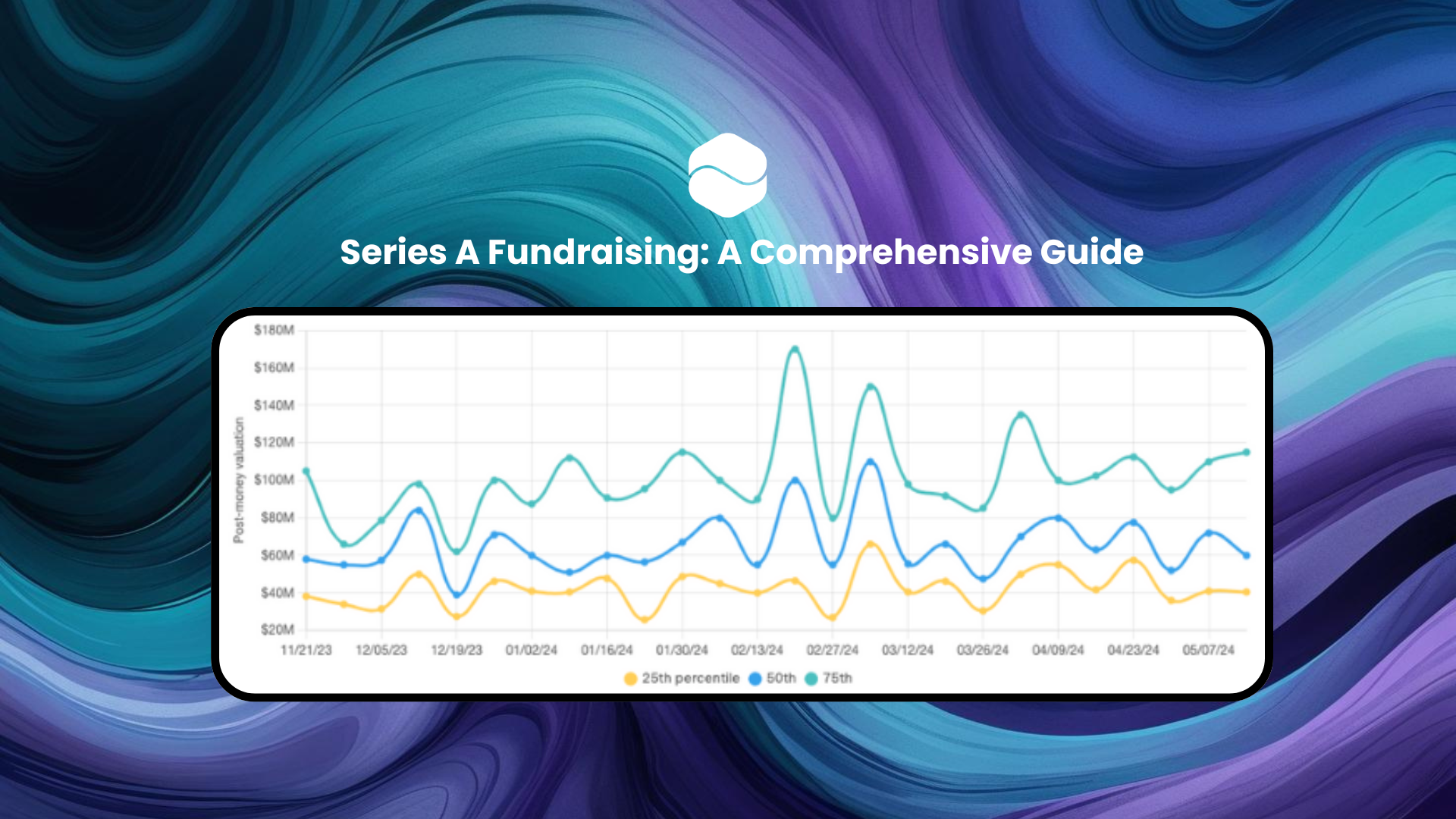

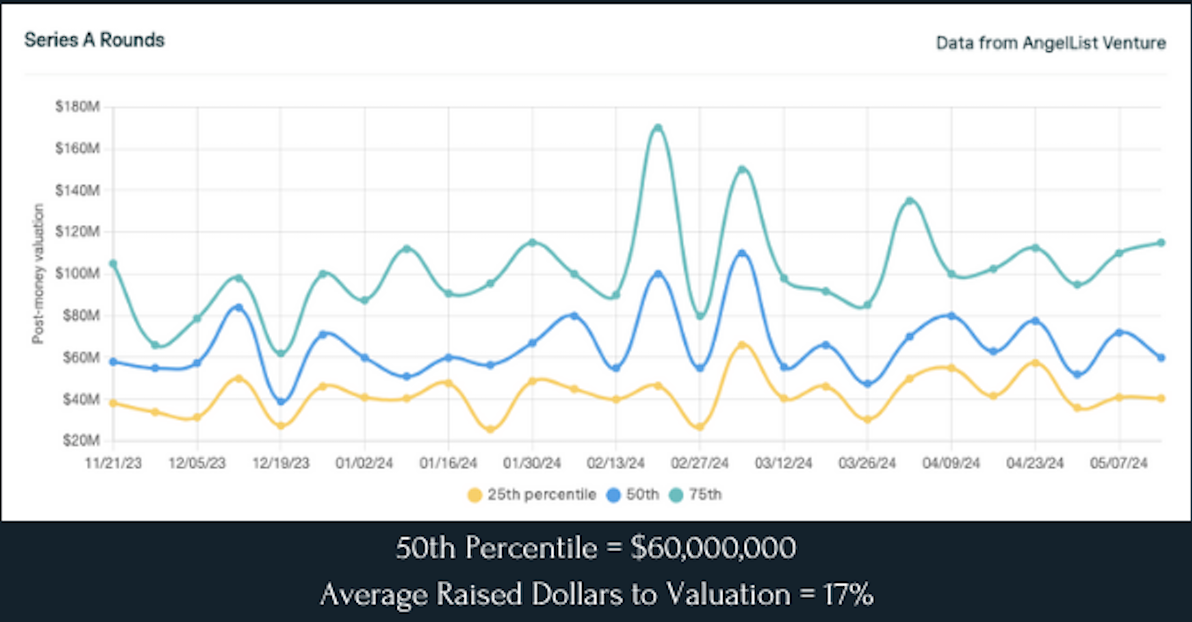

Valuation data from AngelList shows us the Post Money Valuation of most Series A Rounds through 2024, as well as recent 2025 valuation data from Peter Walker at Carta:

What Do Series A Investors Want to See?

When considering a potential investment opportunity, Series A investors are typically looking for the following:

- Validated Product-Market Fit: Investors want evidence that your product solves a real problem for a specific market. This includes user feedback, retention metrics, or early revenue that shows people are not just trying the product—they’re sticking with it.

- Growing Traction: Series A is about scaling what’s already working. Investors look for momentum through metrics like monthly revenue growth, increasing user adoption, or strong customer engagement.

- Clear Go-to-Market Strategies: You need to show that you understand how to reach and convert customers efficiently. This includes sales funnels, customer acquisition cost (CAC), and plans to scale your marketing and sales efforts.

- Compelling Unit Economics: Metrics like CAC, LTV (lifetime value), gross margin, and churn help investors assess whether your business can be profitable at scale. Series A investors want to know that your growth is sustainable.

- Scalable Business Model: Your company should have the infrastructure—or the plan—to support growth without needing to reinvent core processes. That includes technology, operations, and customer success.

- Strong Executive Team: Investors bet heavily on people. They want to see a team with domain expertise, grit, and the ability to recruit talent, execute plans, and adapt quickly.

- Enourmous Market Opportunity: A big, addressable market is essential. Series A investors want to know the company has room to grow and can capture a significant portion of a multi-billion-dollar market.

- Clear Use of Funds and Milestones: Be specific about how you’ll use the Series A capital and what milestones you aim to hit with it—whether that’s revenue targets, product development, team expansion, or entering new markets.

- Clean Cap Table and Legal Hygiene: Investors expect a clear, organized cap table and no major legal red flags. This shows that you’re ready for institutional capital and future rounds.

By addressing these key areas, you can increase your chances of securing Series A funding and setting your business on the path to success.

Conclusion

Raising a Series A round is a pivotal milestone that signals your startup is ready to scale. It requires more than just a good product, it demands a clear vision, strong metrics, a compelling story, and the operational foundation to grow efficiently. By understanding what investors expect, preparing your materials thoughtfully, and running a focused fundraising process, you’ll be better positioned to secure the right partners and the capital you need to reach your next stage. With the right preparation and mindset, Series A isn’t just about raising money, it’s about building momentum for the future. Whether you’re already raising or just getting started, remember: VCs don’t invest in slides, they invest in momentum.